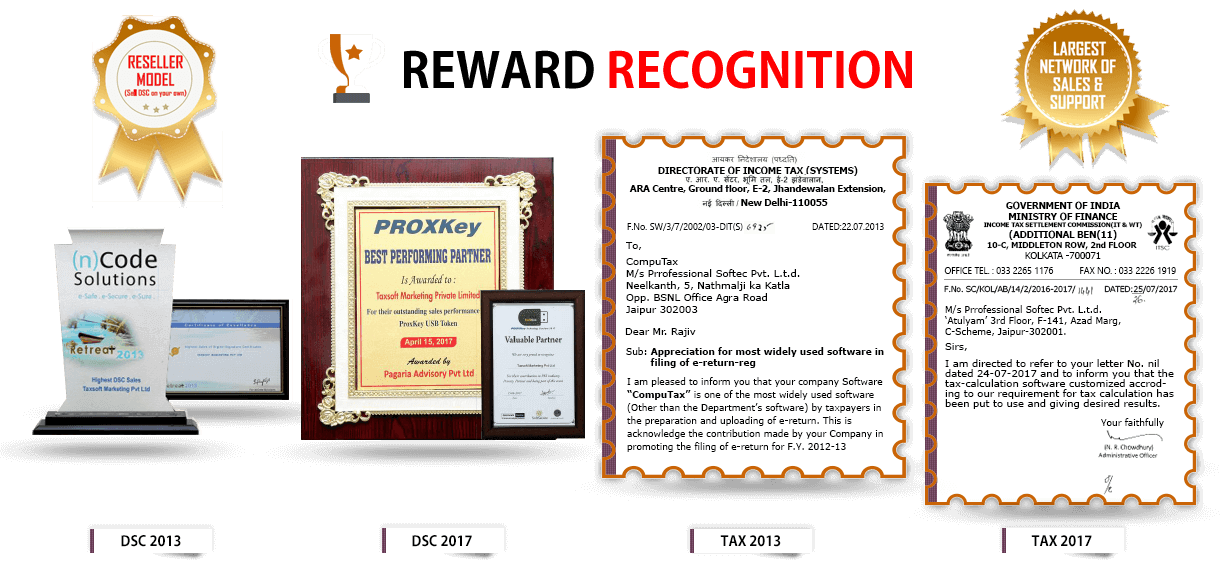

Recognitions[/caption]

Recognitions[/caption]Taxation in India is constantly evolving, and with frequent updates in regulations, deadlines, and return formats, it becomes a challenge for individuals, professionals, and businesses to keep up. Managing income tax returns, GST filings, TDS, payroll, and advance tax calculations manually or using outdated tools can lead to errors, penalties, and lost time. That’s why more professionals and businesses are switching to CompuTax — a smart, scalable, and secure tax compliance software suite built for the Indian ecosystem.

Whether you’re a chartered accountant handling hundreds of clients or a business managing in-house compliance, CompuTax helps you stay on top of every requirement through a unified, intuitive interface. It is trusted by thousands of professionals and organizations across India and continues to grow as a preferred solution due to its reliability, efficiency, and adaptability to regulatory changes.

Powerful Income Tax Software for Accurate Return Filing

CompuTax offers a feature-rich income tax software that helps individuals and professionals prepare and file returns quickly and accurately. It supports all types of ITR forms and is fully compliant with the latest Income Tax Department guidelines.

The software allows easy XML import and export, PAN-wise management of clients, auto tax calculation, and audit report generation. With bulk processing and multi-user access, CA firms can handle large client portfolios with ease. You also get integrated tools for advance tax calculation and comparison reports that help forecast liabilities. Its intuitive dashboard reduces the learning curve, even for new users, and ensures end-to-end transparency.

No more manual form-filling or errors. CompuTax automates the entire process while giving you full control and visibility over every tax filing.

GST Filing Made Simple with Built-In Reconciliation

Dealing with GST compliance—monthly GSTR-1 and GSTR-3B returns, ITC claims, reconciliations, and annual filings—can be overwhelming. But with CompuTax GST filing software, this entire process becomes faster, more accurate, and error-free.

You can import sales and purchase data directly from Excel, Tally, or other ERP systems, and auto-reconcile GSTR-2A and 2B with purchase invoices. The software also supports e-invoicing, e-way bill generation, and multi-GSTIN handling. It ensures that your returns are filed correctly and on time, avoiding penalties and notices from the GSTN.

With smart notifications, summary reports, and return tracking, GST compliance becomes a manageable and streamlined process for businesses and professionals. Regular updates ensure that users are always in line with the latest GST rule changes, reducing compliance risk significantly.

Advance Tax Calculator for Effective Tax Planning

Advance tax is often overlooked until the last minute, resulting in interest charges under sections 234B and 234C. CompuTax solves this with its advance tax calculator, which gives real-time tax estimates based on actual and projected income.

You can compute liabilities for individuals, firms, companies, and HUFs. The system sends due date reminders and allows tax planning through comparative analysis of quarterly payments. It's ideal for professionals managing tax planning services or individuals wanting to stay ahead of their obligations. Historical data tracking and forecasting tools make it a practical asset for year-round planning.

Efficient Payroll Software with Compliance Built-In

CompuTax also offers an advanced payroll software module that simplifies salary processing while ensuring 100% compliance with TDS, PF, ESI, and other labor laws. It's designed for businesses of all sizes—from startups to large enterprises.

With features like auto salary calculation, TDS deduction, Form 16 generation, leave and bonus tracking, and employee self-service portals, managing payroll becomes hassle-free. You can create salary slips in one click and generate statutory reports without any manual intervention.

The software also supports multiple salary structures, arrears, increments, and real-time analytics—making it perfect for HR and finance teams aiming for accuracy and efficiency. Built-in compliance checks ensure that even complex payroll scenarios are handled correctly every time.

Simplify TDS Returns and Deduction Management

Managing TDS filings, especially when you’re dealing with multiple types of payments like salaries, contractor payments, rent, or interest, requires precision and consistency. CompuTax’s TDS filing software offers full support for:

Form 24Q (Salaries)

Form 26Q (Other than Salaries)

Form 27Q (Non-resident payments)

Form 27EQ (TCS)

You can generate FUV files, validate data before uploading to TRACES, and check challans using CIN validation. It also features bulk PAN verification, interest calculation for late deductions, and penalty tracking. This module is especially useful for finance departments and tax consultants managing compliance for multiple clients. Real-time alerts and validation reduce the risk of defaults and corrections.

One Dashboard, All Tax Solutions

What sets CompuTax apart is the way it brings all tax tools—Income Tax, GST, Payroll, TDS, and Advance Tax—under one integrated dashboard. Instead of juggling between different portals and tools, users get a seamless, easy-to-use interface with cloud backup, role-based access control, and regular updates.

This reduces complexity, minimizes errors, and improves compliance outcomes significantly. It also saves valuable time during peak filing seasons and ensures that deadlines are never missed.

Whether you’re an individual taxpayer looking for convenience or a firm aiming to scale operations without increasing costs, CompuTax helps you achieve those goals efficiently.

Who Can Benefit from CompuTax Software?

Chartered Accountants & Tax Consultants: Handle thousands of ITRs, GST filings, and TDS returns without workload stress.

Businesses & Enterprises: Automate payroll, tax deductions, and compliance processes across teams and departments.

Freelancers & Self-Employed Professionals: File returns, calculate advance tax, and manage GST with confidence.

SMEs & Startups: Streamline internal finance and HR operations from day one.

With robust security, high-speed processing, and responsive customer support, CompuTax is a reliable partner for your compliance journey—today and into the future.